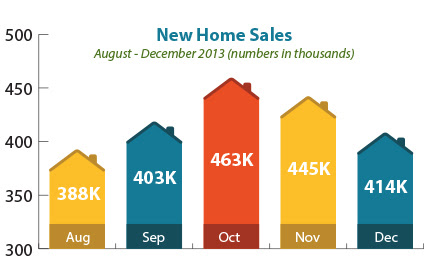

There was a mix of good and bad housing news last week, as Pending Home Sales were down 8.7 percent in December from November. The report cited harsh weather for the decline. New Home Sales also fell by 7 percent from November to December, to an annual rate of 414,000. While the December number was below expectations, there was good news for 2013 overall, as builders sold an estimated 428,000 new homes—16 percent more than in 2012.

There was a mix of good and bad housing news last week, as Pending Home Sales were down 8.7 percent in December from November. The report cited harsh weather for the decline. New Home Sales also fell by 7 percent from November to December, to an annual rate of 414,000. While the December number was below expectations, there was good news for 2013 overall, as builders sold an estimated 428,000 new homes—16 percent more than in 2012.Research firm CoreLogic also reported that completed foreclosures declined 14 percent from December 2012 to December 2013. However, the Case Shiller 20-city Home Price Index fell by 0.1 percent from October to November, the first decline since October to November of 2012. Overall, the housing market continues to improve.

Also of note, December Durable Goods Orders (orders for items that last for an extended period of time) fell by 4.3 percent, the biggest decline since July. Meanwhile, Gross Domestic Product (GDP) in the fourth quarter of 2013 rose by 3.2 percent. This was above expectations, but below the 4.1 percent recorded in the third quarter of last year. The gains were led by a burst of consumer spending and an uptick in business investments. This is significant, as GDP is the broadest measure of economic activity. And inflation continues to remain tame, according to the Personal Consumption Expenditures Index.

What does this mean for home loan rates? Despite some weak economic reports, the Fed decided to taper its Bond purchase program by an additional $10 billion, noting that economic activity has picked up and the labor market continues to improve. Beginning in February, the Fed will now be purchasing $35 billion in Treasuries and $30 billion in Mortgage Bonds (the type of Bonds on which home loan rates are based). These purchases have been designed to stimulate the economy and housing market, and the figure is now down from the $85 billion in Bonds and Treasuries the Fed had been purchasing last year.

The timing of further tapering by the Fed will impact Stocks, Bonds and home loan rates throughout the year. It is a key story to monitor as we move further ahead in 2014.

The bottom line is that now remains a great time to consider a home purchase or refinance, as home loan rates remain attractive compared to historical levels. Let me know if I can answer any questions at all for you or your clients.

I would love the opportunity to help you manage your Lake of the Ozarks Mortgage Loan or refinance. Give me a call at (573) 746-7211 or send me an email at mlasson@fsbfinancial.com with any questions you may have!!

For Lake area news, resources and tips on financial services, please

Sr. Residential Mortgage Lender

NMLS #: 493712

NMLS #: 493712

2265 Bagnell Dam Blvd, Suite B

PO Box 1449

Lake Ozark, MO 65049

Direct: (573) 746-7211

Cell: (573) 216-7258

No comments:

Post a Comment

Note: Only a member of this blog may post a comment.